WACC , or weighted average cost of capital , is the hurdle you use to decide if an acquisition pencils out. It’s the average rate of return a company must earn on its existing assets to satisfy debt holders, equity investors, and other capital providers. In M&A, that hurdle rate is the discount rate in valuation models like DCF and guides deal pricing, financing choices, and post-deal capital structure.

Key definitions and implications: why WACC matters in M&A valuations

What WACC actually represents in M&A

WACC is the combination of two main costs, debt and equity, weighted by their shares in the financing. If you pay more to borrow money or require higher returns from equity, WACC rises and the target’s value decreases in the model. If you can finance at cheaper rates or require lower equity returns, WACC falls and value increases.

Why it matters in M&A and valuation : WACC is the discount rate used in DCF and affects value estimates through cash flows and the cost of capital. In large-cap deals, diversification and debt costs influence WACC , while in small and mid-cap deals risk perceptions influence WACC .

What the numbers say, globally

WACC ranges matter. A composite view shows average WACC around 7.5% for publicly traded firms in 2024, and it varies. Utilities sit around 6%, and tech startups can reach beyond 12% due to risk and growth uncertainty. In New Markets, WACC can spike to 10-15% because of currency and political risk.

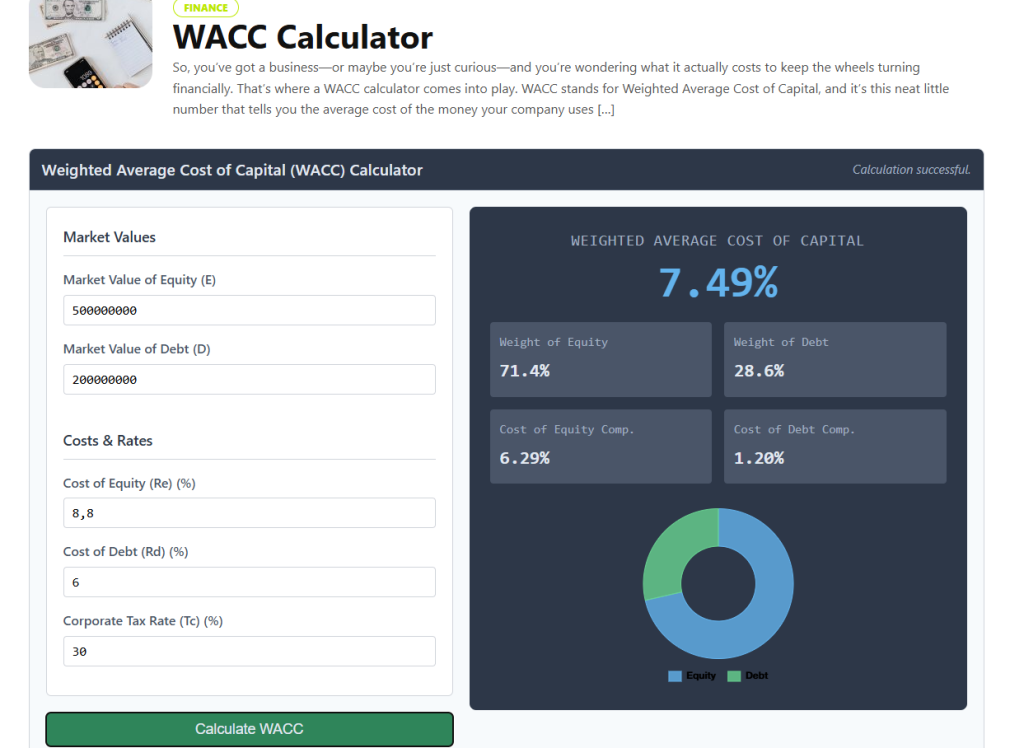

While writing this, I used a calculator that you’re going to love: WACC Calculator

Cost of debt (Rd) : The works well interest rate on the new or target’s debt, adjusted for tax benefits since interest is tax-deductible. If the pre-tax rate is 6% and the tax rate is 30%, after-tax Rd = 6% × (1 – 0.30) = 4.2%.

- Valuation groundwork : Use WACC to run a disciplined DCF on the target’s cash flows. If you’re buyer-side, you’re trying to see if the deal price plus financing cost earns a return above WACC .

- Hurdle rates and decision gates : If your internal IRR target is above the WACC , the deal passes your hurdle; if IRR is below, you revisit price or structure.

- Post-merger planning : After signing, recalculate WACC with the intended capital structure and projected synergies. That helps you map intgration markers to financing needs and value creation.

Practical pitfalls to watch for

- Estimating Re is tricky: It’s sensitive WACC input. Small changes in beta or in the assumed market premium affect WACC .

- Using book values for weights misleads you: Market-based weights reflect current cost of capital.

- ESG and non-financial risks : Investors price sustainability risk, elevating the cost of capital for lower-ESG targets. Consider whether to adjust Rd or Re for these factors. Quick regime shifts: WACC isn’t static. Market volatility, macro shifts, or regulatory changes move WACC . Revisit it when the deal timeline stretches or when a material regulatory change occurs. A tangible demo you can use today.

- Step 1 : Gather target’s market value of equity (E) and debt (D).

- Step 2 : Estimate Rd from current borrowing rates and apply (1 – T).

- Step 3 : Estimate Re via CAPM with current risk-free rate, beta, and expected market premium.

- Step 4 : Compute weights E/V and D/V .

- Step 5 : Plug into the WACC formula and use it as the discount rate in your DCF .

- Step 6 : Compare the DCF value to the offer price and assess value creation versus risk.

Takeaways you can apply now

WACC is the measure used for valuation, financing, and integration planning. It is a signal you update as you move through diligence and closing.

In a global context, WACC varies by region. North American deals have a WACC influenced by regional conditions, while Asia-Pacific and new markets have a WACC influenced by different risk factors. Keep regionally tailored inputs front and center.

Do not ignore ESG and macro risk. They appear as premium adjustments, and ignoring them can understate the true cost of capital and misprice the deal. WACC is a tool for evaluating whether an acquisition makes financial sense, how to finance it, and how value is realized after close. Use it rigorously, review it regularly, and let it guide decisions from start to finish. I want to know how you apply WACC in current deals and whether ESG factors have affected the numbers in practice. Let’s continue.

In M&A, WACC serves as a key indicator of deal feasibility.

The formula and components : WACC = (E/V × Re) + (D/V × Rd × (1 – T)); E is market value of equity, D is market value of debt, V = E + D; Re is cost of equity, Rd is cost of debt, T is tax rate; Weights come from market values, not stale book numbers, to reflect current financing realities.

Financing decisions : WACC informs how you structure the deal. If you rely on more debt, the cost of debt and the tax shield matter; if equity is expensive or scarce, the cost of equity rises and WACC changes. The choice affects debt covenants, use ratios, and post-merger capital strategy.

Post-merger optimization : After closing, you recalc WACC with the new capital structure. The goal is to minimize the overall cost of capital while preserving value creation from synergies. This is an ongoing calibration.

Capital structure context matters too . The global average debt-to-equity ratio in 2023 deals hovered around 0.45, signaling moderate use. Tax rates matter because they affect the after-tax cost of debt; the U.S. corporate rate is 21% after reforms, with other regions ranging widely.

Cost of equity (Re) : Often estimated with CAPM: Re = risk-free rate + beta × (expected market return – risk-free rate). This part is uncertain.

Capital structure weights (E/V and D/V) : Use market values, not book values, to reflect current financing costs and investor expectations. Taxes and other adjustments: Consider country risk, size premiums, and ESG risk premiums if you see investor pushback for sustainability factors. This is increasingly common in practice. When to use WACC in a deal.

I want to know how you apply WACC in current deals and whether ESG factors have affected the numbers in practice. Let’s continue.

| Language | Translation |

|---|---|

| English | WACC (weighted average cost of capital) |

| French | Coût moyen pondéré du capital (WACC) |

| Spanish | Costo medio ponderado de capital (WACC) |

| German | Gewichtete durchschnittliche Kapitalkosten (WACC) |

| Italian | Costo medio ponderato del capitale (WACC) |

Sources:

- https://wisdify.com/mastering-wacc-unlocking-the-power-of-weighted-average-cost-of-capital-in-mergers-and-acquisitions/

- https://valutico.com/weighted-average-cost-of-capital-explained-using-wacc-in-valuations/

- https://www.youtube.com/watch?v=2SsraDyJI7A

- https://corporatefinanceinstitute.com/resources/valuation/what-is-wacc-formula/

- https://www.trading212.com/learn/investing-101/weighted-average-cost-of-capital-wacc